Winter Insurance Tips for Plainview Residents: Partnering with The Larson Group

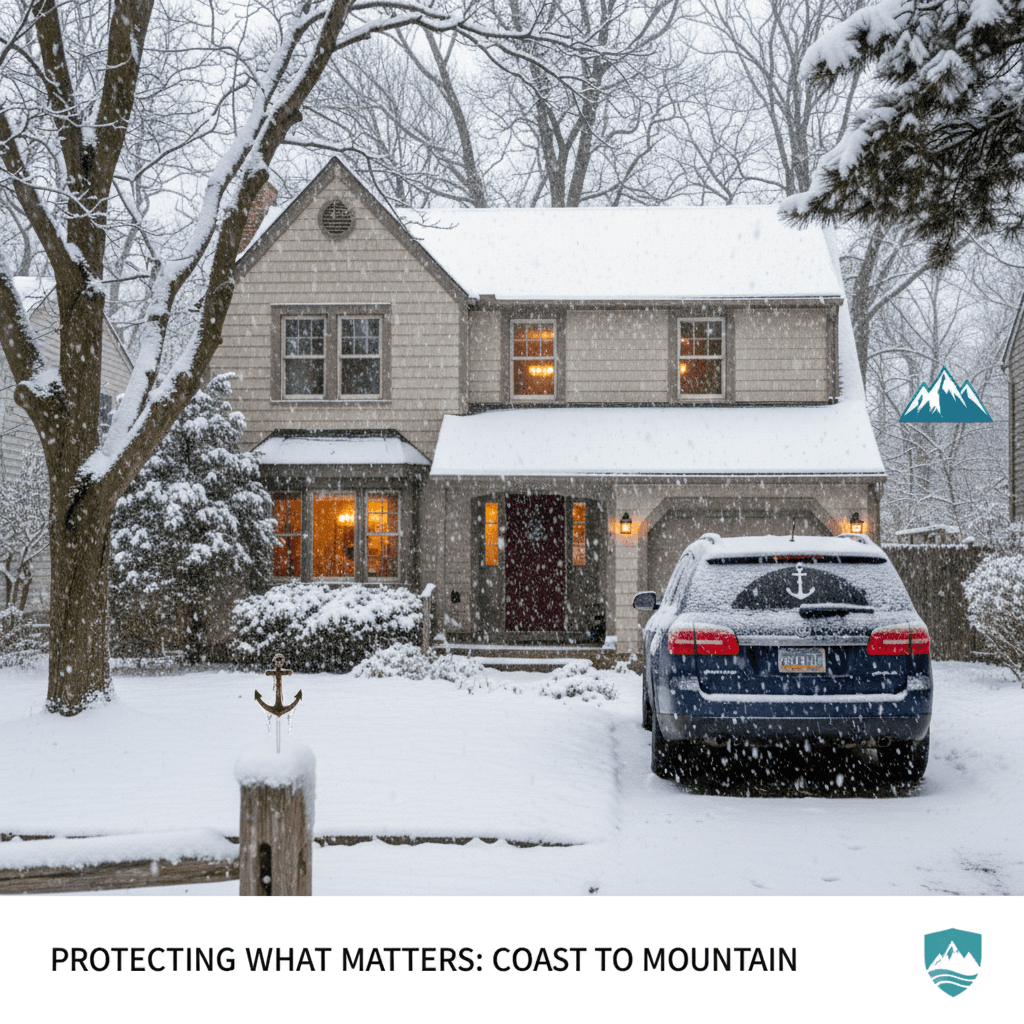

This post offers a Plainview-focused guide to protecting your home, vehicle, and business during Northeast winter storms and tax season. Edward Lehmann Agency teams up with The Larson Group in Woodstock, GA to share actionable insurance tips that keep your coverage resilient and your property secure this February.

Navigating Winter Storm Risks with the Right Insurance in Plainview, NY

We recommend reviewing your property and vehicle policies each February. For homeowners, it’s not just about standard coverage — make sure your protection extends to things like ice dam damage, water backup, and personal belongings. Car owners should double-check collision and comprehensive limits to stay prepared for winter accidents. Business owners, meanwhile, should verify that their commercial property and liability coverages account for snow-related slip-and-falls, shut downs, or structural damage.

Winter Insurance Challenges Unique to Plainview

Expert Tips for Reviewing Policies After the New Year

The Importance of Winterizing With Your Insurance Team

A Regional Perspective: Winter Preparedness from Plainview to Woodstock

Tips for Protecting Your Property and Finances During Plainview Winters

- Schedule an annual review with your insurance agent to assess winter risks specific to Plainview homes.

- Install freeze alarms and update your policy to cover water damage from frozen pipes.

- Consider adding loss-of-use or additional living expense coverage for winter storm evacuations.

- Photograph property and valuable items before peak storm season for accurate claims support.

- Check your auto and commercial vehicle insurance to ensure comprehensive winter accident coverage.

- Ask your agent if seasonal discounts or bundled coverage savings apply this winter.

- Ensure business interruption coverage includes losses from storm-related closures or power outages.

Frequently Asked Questions

What type of homeowners insurance protects against winter storm damage in Plainview, NY?

Standard homeowners insurance usually covers damage from snow, ice, or wind, but you may need extra endorsements for things like sump pump failure or water backup.

How can I prepare my business insurance for winter storms in Plainview?

Review your commercial property and liability policies to ensure you’re covered for snow removal accidents, water damage, and lost income from storm closures.

Are winter driving accidents fully covered by auto insurance in Plainview, NY?

Only if you have comprehensive and collision coverage. Review your current policy with your Plainview agent to check your deductible and limits.

Does my renters or condo policy cover belongings damaged by a power outage from a winter storm?

Most standard policies cover damages from storms, but talk to your agent about additional coverage for spoiled food or electronics damaged by outages.

When is the best time to update my insurance inventory for tax and claim purposes in Plainview?

Update your inventory yearly—ideally in February—so you have accurate records before severe storms or tax season starts.

Can I get discounts for bundling my home and auto insurance during the winter?

Many insurers offer seasonal bundling discounts, which your Plainview agent can help you identify and apply.

Related Articles

Continue reading more articles on similar topics

Have Questions About Your Coverage?

Our team at Lehmann Agency is here to help you understand your insurance options and find the perfect coverage.