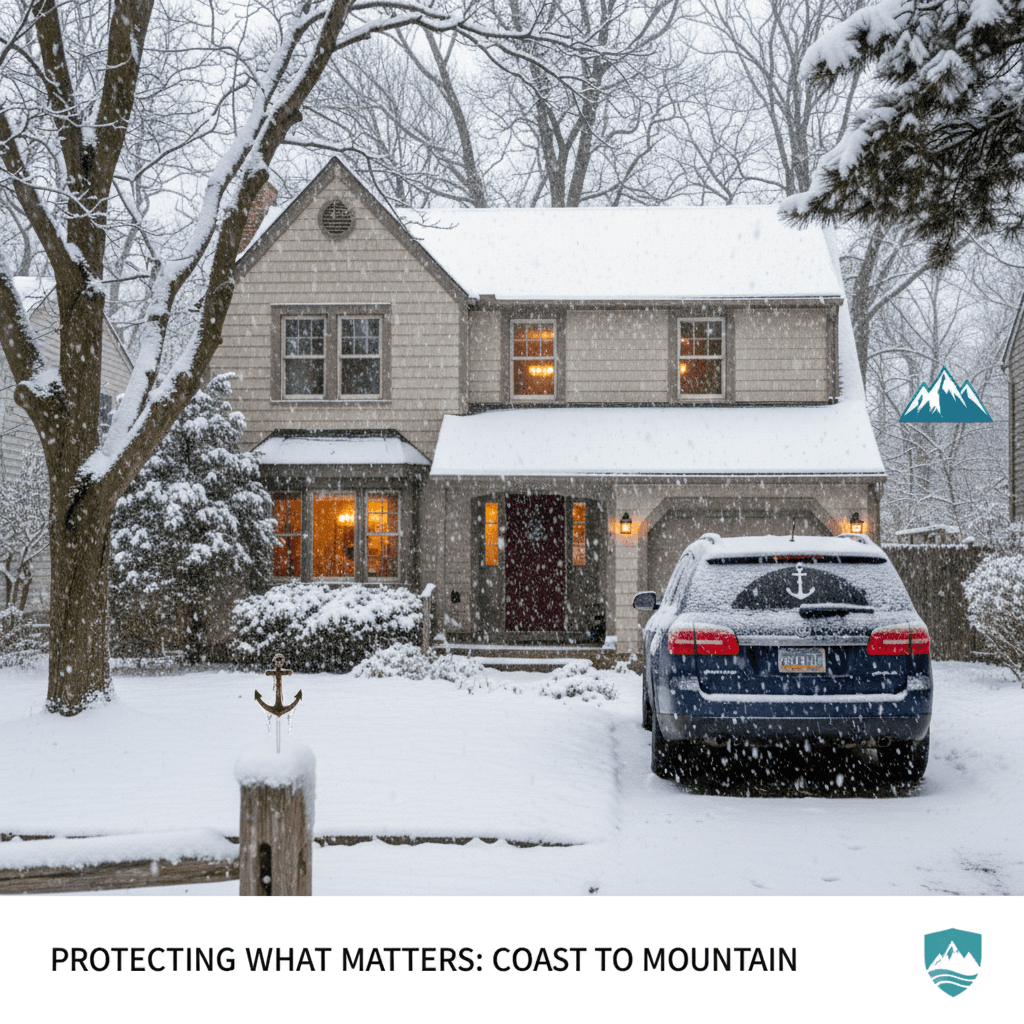

Winter Insurance Essentials: Protecting Your Home and Family in Plainview and Beyond

This seasonal blog from Edward Lehmann Agency explores key winter insurance concerns like homeowners and auto coverage, offering practical Plainview-focused tips. It also spotlights the value of regional insurance partnerships, with a nod to the expertise of The O'Donohoe Agency in Galveston, TX.

Understanding Winter Insurance Needs in Plainview, NY

Local Weather Risks Require Specialized Coverage

The Importance of Auto Insurance During Winter Months

Safeguarding Your Business and Special Events

Regional Connections: Community Support from Plainview to Galveston

Tips for Winterizing Your Insurance and Property in Plainview

- Check your homeowners insurance for protection against ice and snow damage.

- Consider adding flood insurance if you’re at risk from melting snow or winter rains.

- Bundle your auto and home policies to maximize discounts during renewal season.

- Schedule annual policy reviews before winter to identify coverage gaps.

- Protect your small business or event with proper liability and property policies.

- Ask about special winter-related coverage endorsements for your unique needs.

- Document your valuables and property updates for quicker claims processing.

Frequently Asked Questions

How does winter weather affect insurance claims in Plainview, NY?

Winter brings more claims for frozen pipes, ice damage, and accidents. It’s important to review your policies for these risks before the season hits.

What’s the difference between flood insurance and homeowners insurance?

Flood insurance is a separate policy. Homeowners insurance typically won’t cover flooding from storms, melting snow, or rain.

Do I need special coverage for winter events in Plainview?

If you’re hosting an event, special event insurance can shield you from weather cancellations, property damage, or liability claims.

Is auto insurance more expensive during winter in New York?

Rates don’t automatically rise in winter, but claims increase. Adequate collision and liability coverage are recommended for winter driving.

Can I get a discount for bundling my home and auto policies?

Yes! Bundling usually comes with a discount, and it’s a good time to review your policies for seasonal changes.

How soon should I update my insurance before tax season?

It’s smart to review policies prior to tax season, as you may discover deductible insurance premiums or new needs after reviewing your finances.

Related Articles

Continue reading more articles on similar topics

Have Questions About Your Coverage?

Our team at Lehmann Agency is here to help you understand your insurance options and find the perfect coverage.